The gold-silver ratio isn’t just a selection to look at; it’s a Software to wield. Traders can use it in various ways to inform their buying and selling tactics, making use of it being a tutorial to navigate the often-turbulent waters of precious metals trading.

Patrick Heller, a numismatist in Michigan, even built the case in March 2020 which the extensive-phrase price of silver could outpace the extended-phrase cost of gold “by effectively in excess of two occasions from exactly where [it is] at currently.” He believes present-day ratios don’t correctly reflect the marketplace for physical gold and silver.

additional explains that the cost of silver has not matched the new spike in the price of gold because frustrated industrial desire for silver has outweighed shifts from the gold industry. Additionally, modern mining shutdowns have hurt silver production.

Precious metals Have a very track record of holding their worth inside the deal with of cases that might devalue a country's forex.

Investors who anticipate wherever the ratio will probably shift can make a earnings even when the costs of the two metals tumble or increase.

Further than just being familiar with the Gold-Silver Ratio, we offer detailed insights into your broader precious metals market, guaranteeing our purchasers website are well-Geared up to help make educated decisions.

Under is an excellent desk from Jeff Clark at goldsilver.com. It Plainly depicts the possible upside in silver In the event the gold silver ratio heads decrease from right here.

A very good general guideline in deciding which metallic to get is proven inside the chart down below. Consider getting gold when the ratio receives underneath fifty and buy primarily silver when it’s previously mentioned 70. Purchase a little bit of equally in the event the ratio is in the center zone. Currently we remain in the “buy mostly silver” zone.

Once the ratio then contracted to an opposite historical Severe of fifty, such as, the trader would then market their a hundred ounces of silver for two ounces of gold.

As always, conducting extensive investigate and searching for suggestions from the financial advisor when necessary is critical.

The Gold-Silver Ratio, also known as the mint ratio, has an extended and loaded heritage. It's been made use of considering that ancient times when the initial silver and gold coins had been struck.

Gold and silver selections tactics also are available to traders, lots of which contain a form of unfold. Hence, to reply the concern you could be asking oneself concerning the timing within your silver purchases, both a duration of recession and a high gold-silver ratio could be fantastic periods to take a position.

Just before selecting to trade in financial instrument or cryptocurrencies you ought to be completely knowledgeable in the hazards and expenditures affiliated with investing the financial markets, very carefully contemplate your expenditure objectives, level of practical experience, and possibility appetite, and request Specialist assistance in which desired.

The ratio is used by buyers for a gauge of your relative valuation of The 2 metals, which may help tell get and offer selections.

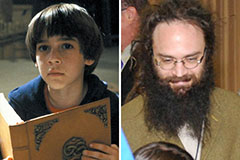

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Barret Oliver Then & Now!

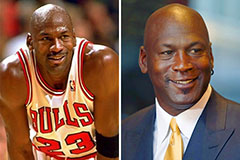

Barret Oliver Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Talia Balsam Then & Now!

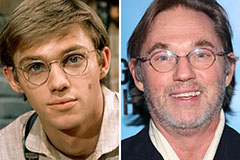

Talia Balsam Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!